Online and Mobile Account Management

Online and Mobile Banking

Enroll for free online access to your Greenville Federal Credit Union accounts. Here are some of the activities you can manage online:

- Check account balances and transaction history

- Perform account transfers and member to member transfers

- View copies of checks

- Make credit union loan payments

- Schedule automatic transfers between accounts or for loan payments

- Apply for a loan or share account

- Download account history

- Send messages to us directly from you account login with online chat support

- Better protect your accounts with enhanced security via two-factor authentication

- Use fingerprint authentication, FaceID, or a 4-digit passcode to quickly, securely access the app. (Bio-metric access is available on devices that allow bio-metric screening.)

- Use popular features like Online Bill Pay, Mobile Check Deposit, eStatements, and more

How to Access

Login for Online Banking is located on the home page of our website.

The new Greenville FCU Banking Mobile App is available for download from App Store and Google Play. The app can be found by searching for Greenville Federal Credit Union. Follow the prompts to install the app.

- Online Banking Tip: If you are a frequent desktop computer user, you should know that Internet Explorer has been replaced by Microsoft Edge and no longer supports the minimum security measures required to keep your data safe. To ensure the best experience possible on desktops, update to the latest version of one of these browsers: Chrome, Firefox, Microsoft Edge, or Safari and clear your cache/history.

Logging In

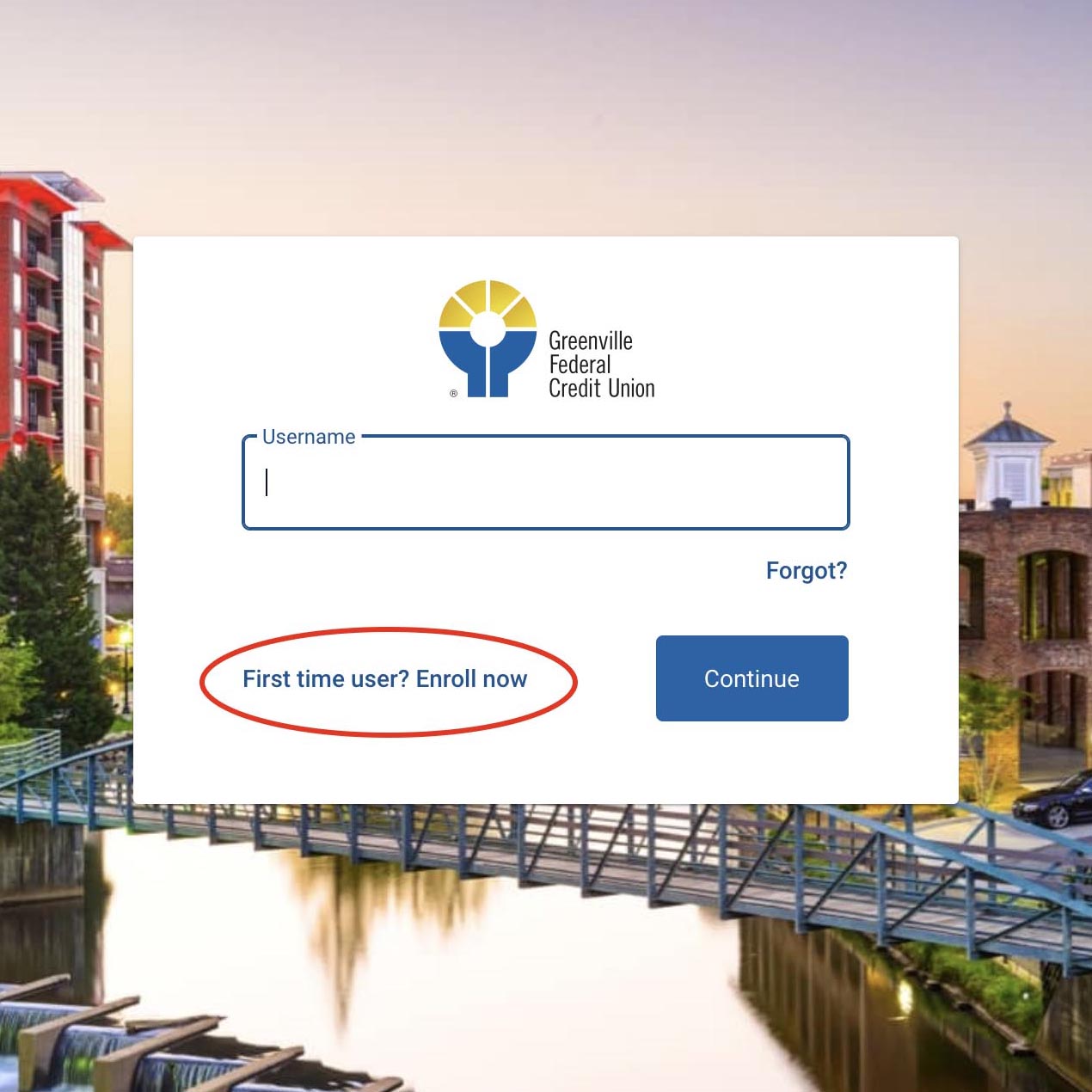

The first time you log in to either version you will need to enroll as a first-time user and follow the prompts to set up your new credentials.

Enhanced Security

During your first login, you will be asked to secure your account by entering the phone number and email address tied to your account. If you log in on a mobile device you'll also be asked to choose a 4-digit passcode.

FAQ

Q. How do I access the new Online Banking or Mobile App?

Login for Online Banking is on the home page of our website. The new Greenville FCU Banking app is available for download from App Store and Google Play. Follow the prompts to install the app.

Mobile App Tip: Delete the old mobile banking app from your phone before installing the new app. IMPORTANT: Be sure to find the new app which does not have the word "Mobile" in the title.

Online Banking Tip: If you are a frequent desktop computer user, you should know that Internet Explorer has been replaced by Microsoft Edge and no longer supports the minimum security measures required to keep your data safe. To ensure the best experience possible on desktops, update to the latest version of one of these browsers: Chrome, Firefox, Microsoft Edge, or Safari and clear your cache/history.

Q. How do I log in to Online or Mobile Banking?

The first time you log in to either the new Online Banking platform or Mobile Banking app you will need to enroll as a first-time user. Select “First time user? Enroll now.” and follow the prompts.

You will then be asked to choose which contact method to which you wish to receive an authorization code. Authorization codes are valid for 3 to 6 minutes. The phone number can be a cell phone or a landline if you prefer to receive a phone call for verification. If you select to receive a phone call instead of a text message, you will be asked to enter a single digit before the verification code is provided to you. If you do not answer the first call, a second is not automatically sent, and the code will not be left on voicemail systems. You will need to begin the process again. The phone number may be listed as coming from anywhere in the US.

Once you complete your verification, you will be prompted to set up new log in credentials. These same credentials will be used for both the Mobile Banking App and Online Banking platform.

A note about setting up credentials: There are different rules for setting up the Username and Password.

Username Rules

Must be between 4 and 20 characters in length.

Must begin with a letter.

Cannot contain special characters.

Password Rules

Must be between 8 and 20 characters in length.

Allowable special characters: !"#$%&(*)+,-/;<=>?[\]^_`{|}'

Q. What is this two-factor authentication?

Two-factor authentication is an additional layer of security that uses a verification code that only a specific user has access to.

Q. Will I be asked for a verification code each time I log in to Online Banking?

If you want to be remembered each time you log in, click the “Don’t ask for codes again” box that appears on the verification code screen. Note: Never select this option when using a public or shared computer.

Q. Can I receive the two-factor verification code via email?

No. The code will be delivered via text message or by voice to a mobile or landline phone.

Q. How do I log off of the Mobile App?

Simply close the app after use.

Q. Will the Mobile App stay open on my mobile device if I don't close it?

Yes, but as a security measure you must re-confirm your sign-in by fingerprint authentication, FaceID, or a 4-digit passcode after a period of inactivity or any time you switch to other apps or functions on your device.

Online Banking will automatically sign you out after a period of inactivity.

Q. How does the Mobile App secure my data?

Whether the Mobile App is closed or not, your data is encrypted on the device and cannot be intercepted while using any network.

As is common practice in Fintech today, all communication between the Mobile App and your device is encrypted locally and sent over TLS 1.2+. This means that all user-entered data—including personal identifiable information—is encrypted before it ever leaves the user’s device.

A user’s device stores a lot of sensitive information. To lessen the likelihood of that information being compromised in the event of a lost or stolen device, the Mobile App encrypts device-held data at rest—that is, the data is rendered unreadable even when it’s not moving across a network. Additionally, all personal identifiable information that is stored on the app's servers is encrypted and adheres to industry standards regarding limitations on who has access to that information.

Q. Will my joint account holders also need to log in and set up new passwords?

Joint account holders will not be able to see the joint account under their own Online/Mobile Banking profile.

Q. Will I be able to see accounts if I am a joint account holder, but not the primary?

No. Only the primary can see the jointly held account in Online/Mobile Banking.

Q. Will I need to acknowledge a new online banking disclosure and end user agreement? Will joint account holders also need to acknowledge a new online disclosure?

Yes. Both the primary account holder and the joint account holder with their own unique user ID will need to “accept” the new online disclosure. The screen to “accept” the new disclosure will appear during your first login to the new system.

Data Usage Disclaimer The Mobile App is free for download; however, as with any app, your use of it may result data charges imposed by your mobile network operator or your internet service provider. You are advised to consult your mobile data or internet data plans to identify the charges which may be incurred prior to the installation and operation of the credit union’s app. The credit union is not responsible for data usage charges. In order for the app to operate fully, the device on which it is used may need to be connected to certain wireless and/or communication based technologies. There may be delays, limitations, and other problems inherent in the use of the internet and electronic communication, of which the credit union has no control.