Credit Score

Check your credit score any time in Online and Mobile Banking

Credit Score® by SavvyMoney gives you real-time updates of your credit score. In addition, you can set up credit monitoring to alert you to any changes to your report. This free feature is available within the security of our Online and Mobile Banking platform.

If you’ve ever wondered what your credit score is, what you could do to improve it, or how to monitor your credit score this is the tool to help you learn.

Getting started.

1. Log in to Online Banking. (Not enrolled in Online Banking? Start here.)

2. Find Credit Score & Report in your Dashboard and select "Show My Score".

3. Review the Terms of Service and click to enroll.

4. Answer a few questions to verify your identity.

5. Your score will appear.

You will only have to go through these steps the first time you use Credit Score. From then on, your score will be displayed when you log in to Online or Mobile banking.

IMPORTANT: The credit score provided is intended to help you understand the factors that affect your credit score, and ways you may be able to save money with Greenville Federal Credit Union loan products. It is not used for loan approval purposes, or for determining loan rates. Loan rates and approvals are based on information provided to the credit union when you apply for a loan. The credit score found in the credit report may be different than the credit score you see in Credit Score. The offers presented are not offers to lend. Terms and conditions and offers are subject to change at any time.

Frequently Asked Questions

Credit Score powered by SavvyMoney is a web-based resource that provides tips and tools to help credit union members pay down their debt and become smarter about money. Credit Score is a free service to help members understand their current credit health and what they need to do to improve it.

Q. What is Credit Score?

A: Credit Score is a comprehensive program designed to help you stay on top of your credit. You’ll get your credit score, an understanding of the key factors that impact it, and access to special loan and credit card offers that can help you reduce interest costs. With this program, you’ll always know where you stand with your credit and where you can potentially save money. This program will also monitor your credit report on a daily basis to help you keep an eye out for identity theft. You’ll be informed by email if any big changes are detected – a new account has been opened, a change in address or employment occurs, a delinquency has been reported, or an inquiry has been made.

Q. Is there a fee?

A. No. Credit Score is entirely free. Log in as often as you want to check your score, which is updated monthly. No credit card information is required to register.

Q: Will accessing my Credit Score in Online Banking lower my credit score?

A: No. When you check Credit Score in Online Banking, it is a “soft inquiry,” which does not affect credit scores. A “hard inquiry” is what appears in a credit report. Hard inquiries are used by lenders when members apply for loans to make decisions about their creditworthiness. Too many hard inquiries may lower a credit score.

Q. Is the SavvyMoney Credit Score an actual credit report?

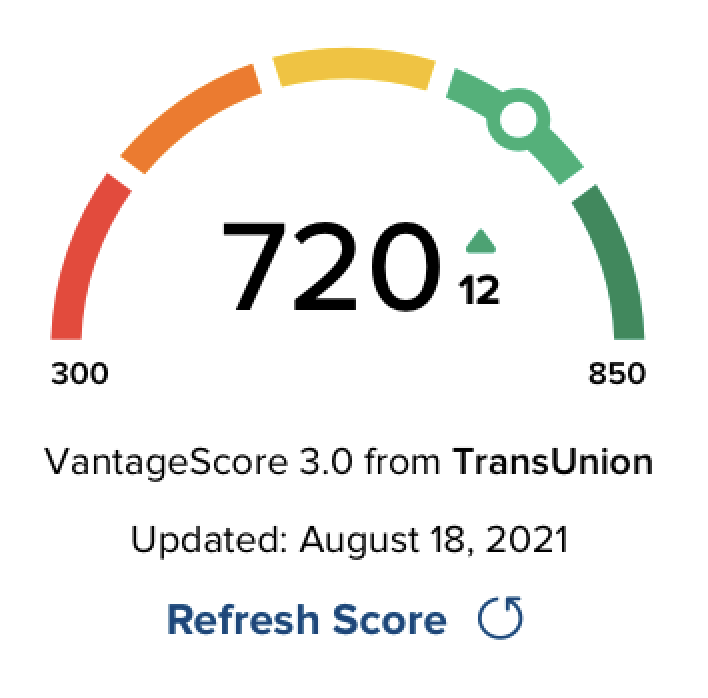

A. No. SavvyMoney shows your credit score, ranging from 300 to 850, but it doesn’t include an actual credit report (a detailed report of credit history).

Q: What if I don’t have a credit history?

A: If you don’t have a credit history, you can still view the educational articles. In some cases, you may also be eligible for loans or credit cards that will help you build your credit.

Q. How often are credit scores updated?

A. The credit scores are automatically updated every 30 days, although you can click “update” to refresh it every day. Under the credit score, there is an indicator of any changes (+ or -) since the last update, so you can see how the changes you’ve made have affected your score.

Q. Can I request a free credit report from SavvyMoney?

A: Not at this time. However, you can pull one copy of your credit report from each bureau annually at www.annualcreditreport.com or by calling 877-322-8228. By pulling one report every four months, you’ll be able to stay on top of your credit and spot any inaccuracies or suspicious activity quickly.

Q.How does the SavvyMoney Credit Score differ from other credit scoring offerings?

A: SavvyMoney gets members’ credit histories from Transunion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

Q: Why do credit scores differ?

A: There are three major credit reporting bureaus—Equifax, Experian and TransUnion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges: Excellent 781–850, Good 661-780, Fair 601-660, Poor 501-600, Bad Below 500.

Q: What if the information provided by SavvyMoney Credit Score appears to be wrong or inaccurate?

A: The SavvyMoney Credit Score is not intended to be comprehensive and may not provide information about all your accounts. That’s why we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.comto look for any incorrect information or discrepancies. Each bureau has its own process for correcting inaccurate information. The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.

Q: There is a section in Credit Score that features financial education articles. Can you explain more about this?

A: The educational articles are designed to provide helpful tips on how to manage credit and debt wisely.

Q: There is a section in Credit Score that features product offers? Can you explain more about this?

A: Depending on your credit score, you may receive offers on products that may be of interest to you. These offers are tailored specifically for you based on your credit history, so you’ll always know what rates you may be eligible for. In many cases, the loan and credit card offers will have lower interest rates than the products you already have and may be able to help save you money.

Q: Does Credit Score monitor my credit report?

A: Yes. When you successfully pull your credit score for the first time, you are automatically enrolled into credit monitoring. Your file is scanned daily for key changes, and an alert will be sent to you via email if one of the following key changes are detected:

•An account has been included in bankruptcy

•An account is reported as delinquent

•A fraud alert has been placed on the credit file

•A previously derogatory account is now current

•A new account has been opened

•An account in your name shows a different address

•An account in your name lists a new employer

•A new inquiry appears on the credit file

•A new public record has been reported

Q. How do I change my email address or other personal information?

A: If you access Credit Score through our online banking site, your email address will get updated automatically when you update it in online banking.

Q: Will I receive an actual credit report?

A: No. With this program you’ll receive your credit score, ranging from 300 to 850, and key factors that are impacting your score. It does not include an actual credit report (a detailed report of credit history).

Q. How does the SavvyMoney Credit Score differ from other credit scoring offerings?

A: SavvyMoney gets members’ credit histories from Transunion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.