Credit Union Advocacy

Don't tax my credit union.

Source: America's Credit Unions

During times of economic uncertainty, consumers count on community institutions that put people first and empower them to find success. Here in the Upstate, Greenville Federal Credit Union is one of those institutions. We uphold daily our mission of “people helping people.” Over 140 million Americans – including 1.7 million in South Carolina - rely on credit unions like ours for their financial services and our people first approach.

But there’s a threat looming that would put credit unions at risk. Congress is tackling tax reform, and some in Washington, D.C., are suggesting a new tax on credit unions. That would be a new tax on hard working Americans who depend on credit unions for their financial services.

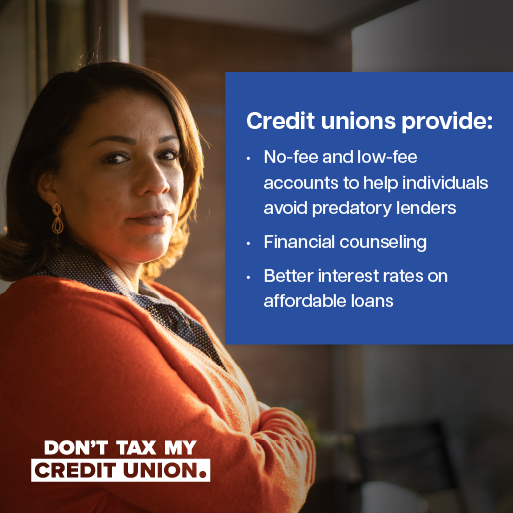

While big banks operate solely for the profit and benefit of their shareholders, credit unions are not-for-profit financial cooperatives – owned by their members with a focus on serving them, regardless of their financial status. This is what we call the “credit union difference.”

Credit unions pay a host of federal, state, and local taxes, but because we reinvest profits back into our member-owners and the community we serve, we do not pay the federal income tax on profits. This vital tax status allows credit unions, like Greenville Federal Credit Union, to offer lower fees, better loan terms, and higher deposit yields than for-profit banks. The credit union tax status delivers a 1,300% return on investment that goes back into our local communities. Even people who aren’t credit union members benefit from having a credit union in the community.

Greenville Federal Credit Union is committed to providing our community with access to the credit union difference. We step up when others step away, and use our mission, focus and resources to create financial solutions for consumers who need them most.

The tax status is crucial to all credit unions’ survival and continued ability to serve people left behind by banks. As cooperatives, credit unions succeed when people come together. We are stronger when we advocate and act with one unified voice. And your help in protecting credit unions as a financial partner is needed now more than ever.

Take action.

Support your community’s access to more affordable financial choices by saying no to a tax on credit unions. Tell Congress “Don’t Tax My Credit Union” because a tax on credit unions is a tax on you.

Visit Don't Tax My Credit Union to learn how.

Be an advocate for your credit union.

A simple way to take part is by contacting your lawmakers and expressing your interest in protecting your credit union's tax exempt status.

We encourage all members learn about current legislation affecting our credit union.

Legislative affairs and political action.

Greenville Federal Credit Union is part of the Carolina's Credit Union League and the Credit Union National Association (CUNA), a national organization based in Washington, D.C., and Madison, Wisconsin. These organizations work together to provide legislative support to all credit unions and coordinate congressional efforts at State and Federal levels.