In January, we’ll debut the brand-new Greenville Federal Credit Union website, and we are so excited for you to experience the next level of member service. The new website will feature a sleek new look that will bring us confidently into the modern era. The best part? Everything you need is exactly where you want it to be.

You can still find us at www.greenvillefcu.com

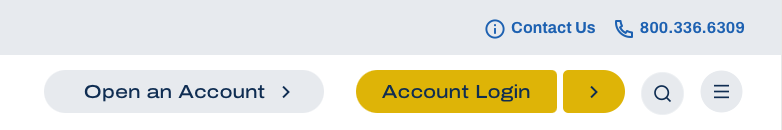

The new site will look different, but the Account Login button? It will be where you expect it to be, prominently featured in the top right corner of the screen. You’ll have the same easy access to your accounts and features, but served to you in a clean, modern way. Two of the features we’re most excited to share with you are our revamped calculators and our smart Help Center. More on those later. First, we want to make sure you know your way around the new site.

What you need, where you need it

As mentioned previously, as soon as you visit the new site, you’ll see the Account Login button in eye-catching yellow at the top right corner of the screen. Directly beside the account login button will be a magnifying glass icon. This will take you to our updated and intuitive search function. Find what you’re looking for with ease, as the new search function will deliver the results you need. Beside the search button, you’ll see a circle with three lines in it. Click on this to expand our menu. Use the menu to navigate to our products and services.

You’ll also notice a dropdown at the top left corner. Utilize this tool to translate the website into a variety of different languages.

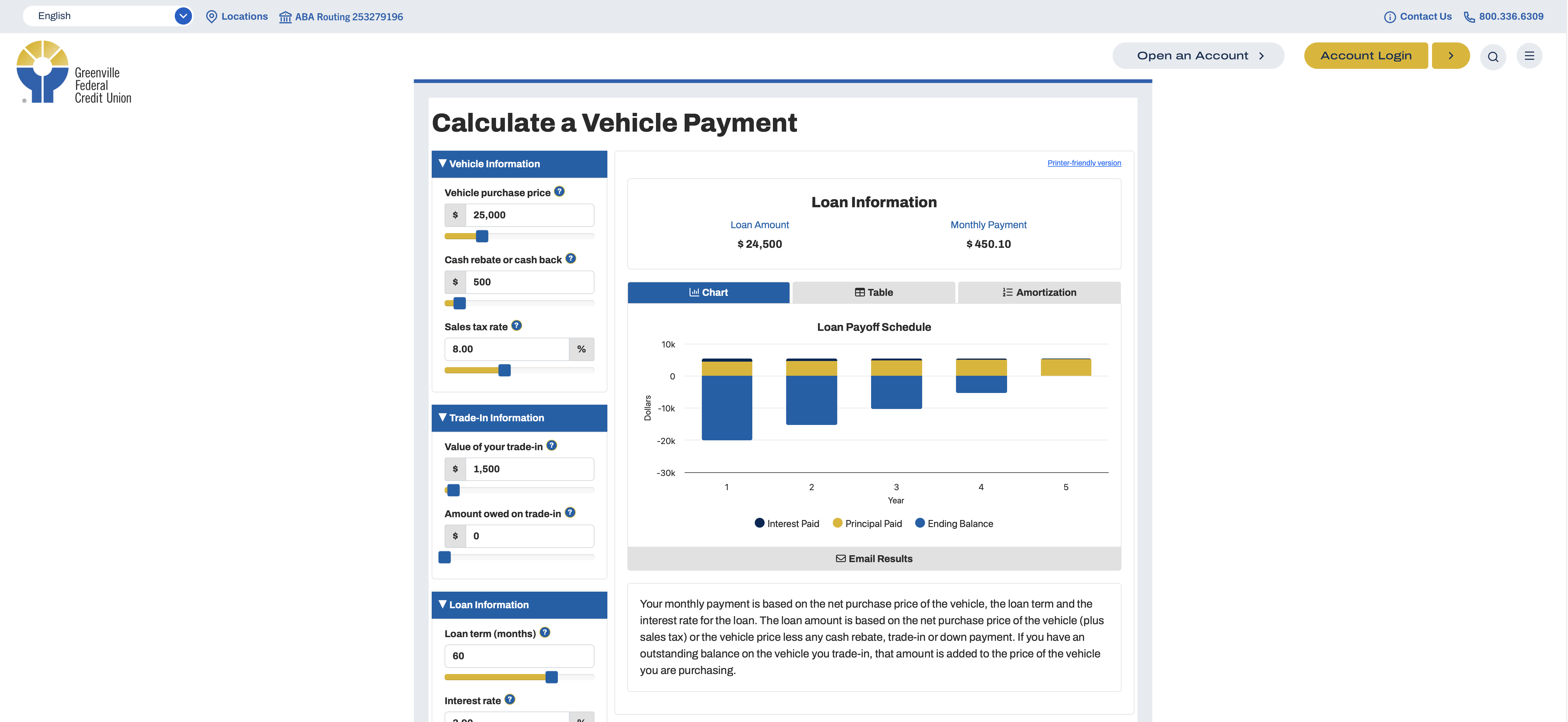

Calculators you’ll want to use

With over 50 vibrant and easy-to-use calculators, you’ll be able to calculate auto payments, project savings yields, and even speculate on how long your retirement savings will last. You’ll also be able to email yourself a copy of your calculations.

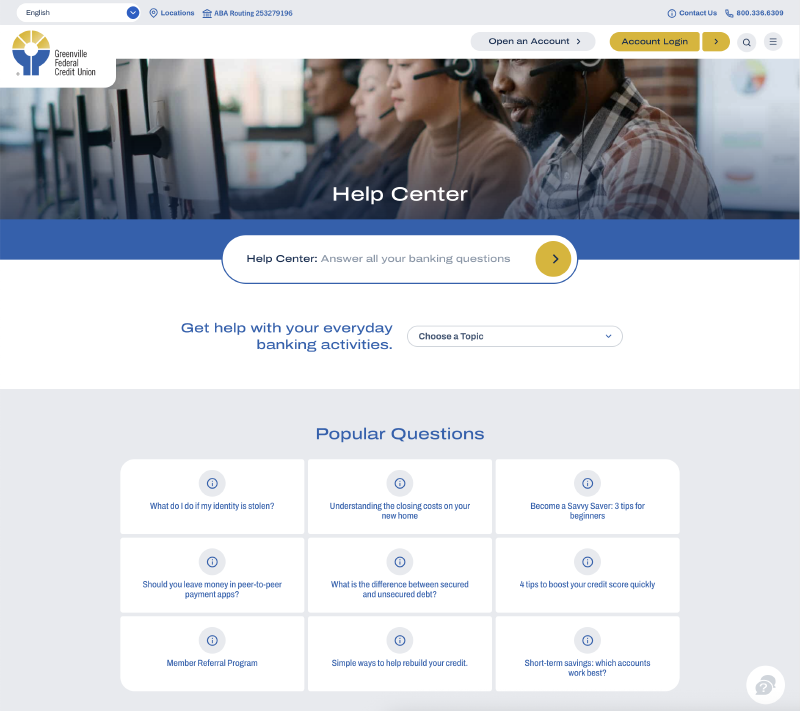

An intuitive and smart Help Center

A brand-new feature will be our Help Center. The Help Center is the place to find the answers to your questions. The Help Center will be populated with helpful articles, money-saving tips, and information that could be vital to your financial wellbeing. Explore the answers to popular questions, browse our list of topics, or ask your own questions. Finding the info you need has never been easier.