Special Relief loan is designed to help with disaster-related expenses

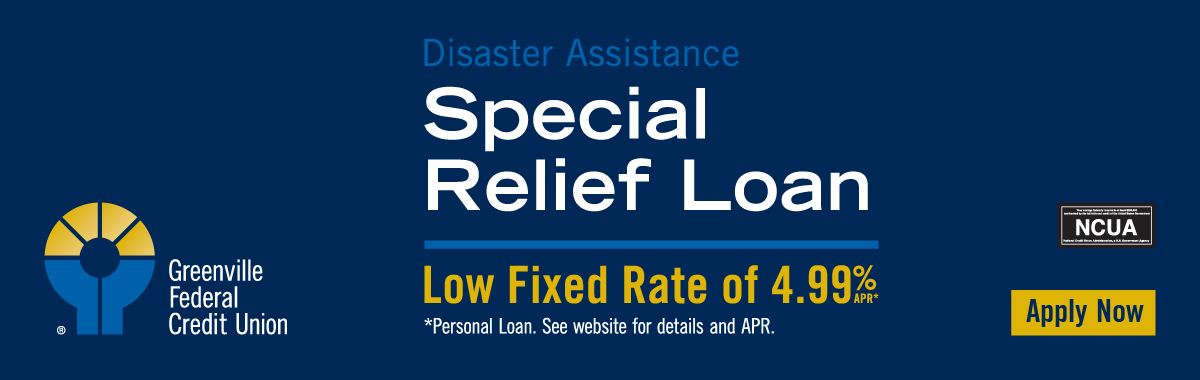

October 7, 2024 - Greenville, SC Less than five days after Hurricane Helene stormed through Greenville and Western North Carolina, Greenville Federal Credit Union has launched a special loan to cover disaster-related expenses. Available to all members, new and existing, the Special Relief personal loan offers a low, 4.99% APR fixed rate and terms up to 72 months, and can be used for a range of needs including tree removal, damages, lost wages, insurance deductibles, food replacement, appliance replacement, and more.

“Once the credit union regained power and opened the majority of our branches after the storm, we focused our efforts on identifying how we might best support our members and community through this historic event,” said Paul Hughes, credit union President and CEO. “It became clear almost immediately that most people across our area were suddenly facing extreme financial burdens, beyond our typical winter power outage problems. We knew offering access to a low-cost personal loan option would be the best way we can help.”

So far loan applicants have used the Special Relief loan to assist with rent payments, damages, and food replacement. The credit union is also offering additional assistance to existing loan holders through Skip-a-Pay and payment deferment options.

Anyone who lives, works, worships, or attends school in Greenville County is eligible to join the credit union and apply for a Special Relief loan. Learn more about the Special Relief loan and other resources at www.greenvillefcu.com/disaster-assistance.

About

Greenville Federal Credit Union

Greenville Federal Credit Union is a not-for-profit financial alternative to traditional banking with six branch locations in Greenville County serving more than 34,000 members. The $455 million credit union was founded by nine employees from the School District of Greenville County as an educator’s credit union in 1968. In 2001, the credit union approved a conversion to a community-based charter to serve anyone who lives, works, worships, or attends school in Greenville County. The National Credit Union Administration (NCUA), an agency of the federal government, insures all accounts up to $250,000. For more information, please visit the credit union’s website at www.greenvillefcu.com or call 800.336.6309.

*Annual Percentage Rate as of 10/03/2024. Offer applies to new loans and is subject to credit approval and membership eligibility. Your payment amount will vary depending on term and amount borrowed. A 36-month Special Relief Personal loan with 4.99% APR would have monthly payments of $29.97 per thousand borrowed. Maximum term is 72 months. Interest will accrue during the 90-day no payment period. Offer can end at any time.