Mobile Deposit Terms & Conditions

Remote/Mobile Deposit Capture Terms and Conditions Agreement

This Remote Deposit Capture Agreement ("Agreement") contains the terms and conditions Greenville Federal Credit Union ("Credit Union", "us," "we," or “our”) may provide you ("you," “your”, or "User"). Other agreements you have entered into with the Credit Union, including your Membership Agreement and/or Business Membership Agreement, as amended from time to time, are incorporated by reference and made a part of this Agreement.

Services

Remote deposit capture services ("Service(s)") are designed to allow you to make deposits to your credit union qualifying checking accounts from remote locations by scanning/imaging checks and delivering the images and associated deposit information to the Credit Union or the Credit Union’s designated processor.

Acceptance of these Terms

Your use of the Services constitutes your acceptance of this Agreement. This Agreement is subject to change from time to time. We will notify you of any material change. You will be prompted to accept or reject any material change to this Agreement the next time you use the Service after we have made the change. Your acceptance of the revised terms and conditions, along with the continued use of the Services, will indicate your consent to be bound by the revised Agreement. Further, we reserve the right, in our sole discretion, to change, modify, add, or remove portions from the Services. Your continued use of the Services will indicate your acceptance of any such changes to the Services.

Limitations of Service

When using the Services, you may experience technical or other difficulties. We may attempt to notify you of these interruptions in Service, but cannot assume responsibility for any technical or other difficulties or any resulting damages that you may incur. Some of the Services have qualification requirements, and we reserve the right to change the qualifications at any time without prior notice. We reserve the right to change, suspend or discontinue the Services, in whole or in part, or your use of the Services, in whole or in part, immediately and at any time without prior notice to you.

Hardware and Software

In order to use the Services, you must obtain and maintain, at your expense, compatible hardware and software as specified by the Credit Union from time to time. See www.greenvillefcu.com/mobile-account-management for current remote deposit capture hardware and software specifications. The Credit Union is not responsible for any third party hardware or software you may need to use the Services. Any such third party hardware or software is accepted by you “as is” and is subject to the terms and conditions of the hardware or software agreement you enter into directly with the provider at time of acquisition, download, and/or installation.

Fees

Presently there is no fee for the Service; however, a fee may be charged for the Service in the future. You are responsible for paying the fees for the use of the Service. Any fee that is charged will be disclosed prior to your deposit or in our Rate and Fee Schedule. The Credit Union may change the fees for use of the Service at any time pursuant to the Acceptance of these Terms noted above. You authorize us to deduct any such fees from any Credit Union account bearing your name.

Eligible items

You agree to deposit only "checks" as that term is defined in Federal Reserve Regulation CC ("Reg. CC"). When the image of the check transmitted to Credit Union is converted to an Image Replacement Document for subsequent presentment and collection, it shall thereafter be deemed an "item" within the meaning of Articles 3 and 4 of the Uniform Commercial Code.

You agree that you will not deposit any of the following types of checks (or other items) which we considered ineligible:

- Checks payable to any person or entity other than the person or entity owning the account the check is being deposited into

- Checks containing any alteration or which you know, suspect, or should know or suspect, is fraudulent or otherwise not authorized by the owner of the account on which the check is drawn

- Checks jointly payable, unless deposited into an account in the name of all payees

- Checks previously converted to a substitute check, as defined in Reg. CC

- Checks drawn on a financial institution located outside the United States

- Checks that are remotely created checks, as defined in Reg. CC

- Checks not payable in United States currency

- Checks dated more than 6 months prior to the date of deposit

- Checks prohibited by Credit Union’s current procedures relating to the Services or which are otherwise not acceptable under the terms of your Credit Union Membership Agreement

- Checks payable on sight or payable through Drafts, as defined in Reg. CC

- Checks with any endorsement on the back other than that specified in this Agreement

- Checks that have previously been submitted through the Service or through a remote deposit capture service offered at any other financial institution

- Checks that are in violation of any federal or state law, rule, or regulation

- Checks we deem, in our sole discretion, unsuitable through the Service

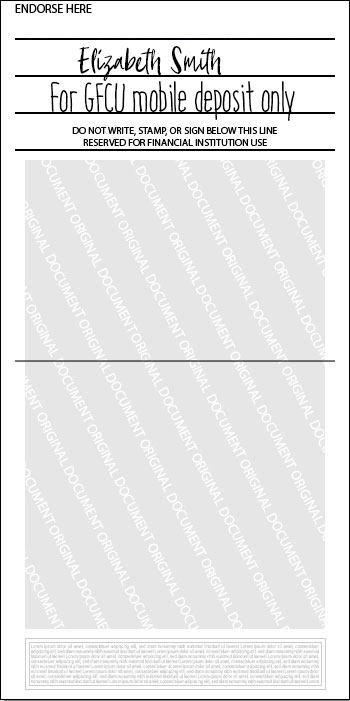

Endorsements, Requirements and Procedures

You agree to legibly and restrictively endorse any check transmitted through the Services as "GFCU MOBILE DEPOSIT” and sign your name as written on the Payee line on the front of the check. Each image must provide all information on the front and back of the original check at the time presented to you by the drawer, including, but not limited to, information about the drawer and the paying bank that is preprinted on the original check, MICR information, signature(s), any required identification written on the front of the original check and any endorsements applied to the back of the original check. The image quality must meet the standards established by the American National Standards Institute, the Board of Governors of the Federal Reserve, and any other regulatory agency, clearing house or association. You agree to follow any and all other procedures and instructions for use of the Services as the Credit Union may establish from time to time.

Receipt of Items

We reserve the right to reject any item transmitted through the Services, at our discretion, without liability to you. We are not responsible for items we do not receive or for images that are dropped during transmission. An image of an item shall be deemed received when you receive confirmation from the Credit Union that we have received the image, generally indicated by a green checkmark if a successful transmission or a red ‘X’ if a failed transmission, when you submit your deposit. Receipt of such confirmation does not mean that the transmission was error free, complete or will be considered a deposit and credited to your account. We further reserve the right to reject or charge back to your account at any time any item that we subsequently determine was not an eligible item. You agree that the Credit Union is not liable for any loss, costs, or fees you may incur as a result of our chargeback or rejection of an ineligible item. The Credit Union will attempt to notify you by email of items we reject after receipt or place on hold, so keeping your contact information up to date with us is important.

Availability of Funds

You agree that items transmitted using the Services are not subject to the funds availability requirements of Federal Reserve Board Regulation CC. In general, if an image of an item you transmit through the Service is received and accepted before 2:00 p.m. Eastern Time on a business day that we are open, we consider that day to be the day of your deposit. Otherwise, we will consider your deposit was made on the next business day we are open. Funds deposited using the Services will generally be made available in two business days from the day of deposit. We may make such funds available sooner based on such factors the Credit Union, in its sole discretion, deems relevant.

Disposal of Transmitted Items

Upon your receipt of a confirmation from the Credit Union that we have received an image that you have transmitted, you agree to retain the check for at least 30 calendar days from the date of the image transmission. After 30 days, you agree to destroy the check that you transmitted, mark it "VOID", or otherwise render it incapable of further transmission, deposit, or presentment. During the time the retained check is available, you agree to promptly provide it to the Credit Union upon request.

Deposit Limits

We may establish limits on the dollar amount and/or number of items or deposits made through the Service from time to time. If you attempt a deposit in excess of these limits, we may reject your deposit. If we permit you to make a deposit in excess of these limits, such deposit will still be subject to the terms of this Agreement, and we will not be obligated to allow such a deposit at other times. The current daily dollar limit is $5,000.00 per business day.

Presentment

The manner in which the items are cleared, presented for payment, and collected shall be our sole discretion subject to the terms governing your account.

Errors

You agree to notify the Credit Union of any suspected errors regarding items deposited through the Services right away, and in no event later than 30 days after the applicable account statement is sent. Unless you notify us within 30 days, such statement regarding all deposits made through the Services shall be deemed correct, and you are prohibited from bringing a claim against the Credit Union for such alleged error.

Errors in Transmission

By using the Services you accept the risk that an item may be intercepted or misdirected during transmission. The Credit Union bears no liability to you or others for any such intercepted or misdirected items or information disclosed through such transmissions.

Image Quality

The image of an item transmitted through the Services must be clear and legible, as determined in the sole discretion of the Credit Union. Without limiting the foregoing, the image quality of the items must comply with the requirements established from time to time by the Credit Union, ANSI, the Board of Governors of the Federal Reserve Board, and/or any other regulatory agency, clearinghouse or association.

User Warranties and Indemnification

You warrant to the Credit Union that:

- You will only transmit eligible items

- You will not transmit duplicate items

- You will not re-deposit or re-present the original item

- All information you provide to the Credit Union is accurate and true

- You will comply with this Agreement and all applicable rules, laws and regulations

- You are not aware of any factor which may impair the collectability of the item

- You warrant that files submitted by you to the Credit Union do not contain computer viruses or malware

- You agree to indemnify and hold harmless Credit Union from any loss for breach of this warranty provision

Cooperation with Investigations

You agree to cooperate with us in the investigation of unusual transactions, poor quality transmissions, and resolution of customer claims, including by providing, upon request and without further cost to the Credit Union, any originals or copies of items deposited through the Service in your possession and your records relating to such items and transmissions.

Termination

We may terminate this Agreement at any time and for any reason. This Agreement shall remain in full force and effect unless and until it is terminated by us. Without limiting the foregoing, this Agreement may be terminated if you breach any term of this Agreement, if you use the Services for any unauthorized or illegal purposes or you use the Services in a manner inconsistent with the terms of any other agreement with us.

Enforceability

We may waive enforcement of any provision of this Agreement. No waiver of a breach of this Agreement shall constitute a waiver of any prior or subsequent breach of the Agreement. Any such waiver shall not affect our rights with respect to any other transaction or to modify the terms of this Agreement. In the event that any provision of this Agreement shall be deemed to be invalid, illegal, or unenforceable to any extent, the remainder of the Agreement shall not be impaired or otherwise affected and shall continue to be valid and enforceable to the fullest extent permitted by law.

Ownership & License

You agree the Credit Union retains all ownership and proprietary rights in the Services, associated content, technology, and website(s). Your use of the Services is subject to and conditioned upon your complete compliance with this Agreement. Without limiting the effect of the foregoing, any breach of this Agreement immediately terminates your right to use the Services. Without limiting the restriction of the foregoing, you may not use the Services (i) in any anti-competitive manner, (ii) for any purpose which would be contrary to the Credit Union’s business interest, or (iii) to the Credit Union’s actual or potential economic disadvantage in any aspect. You may not copy, reproduce, distribute or create derivative works from the content and agree not to reverse engineer or reverse compile any of the technology used to provide the Services.

DISCLAIMER OF WARRANTIES

YOU AGREE YOUR USE OF THE SERVICES AND ALL INFORMATION AND CONTENT (INCLUDING THAT OF THIRD PARTIES) IS AT YOUR RISK AND IS PROVIDED ON AN "AS IS" AND "AS AVAILABLE" BASIS. WE DISCLAIM ALL WARRANTIES OF ANY KIND AS TO THE USE OF THE SERVICES, WHETHER EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO THE IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. WE MAKE NO WARRANTY THAT THE SERVICES (i) WILL MEET YOUR REQUIREMENTS, (ii) WILL BE UNINTERRUPTED, TIMELY, SECURE, OR ERROR-FREE, (iii) THAT THE RESULTS OBTAINED FROM THE SERVICE WILL BE ACCURATE OR RELIABLE, AND (iv) THAT ANY ERRORS IN THE SERVICES OR TECHNOLOGY WILL BE CORRECTED.

LIMITATION OF LIABILITY

YOU AGREE THAT WE WILL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR EXEMPLARY DAMAGES, INCLUDING, BUT NOT LIMITED TO DAMAGES FOR LOSS OF PROFITS, GOODWILL, USE, DATA OR OTHER LOSSES RESULTING FROM THE USE OR THE INABILITY TO USE THE SERVICES INCURRED BY YOU OR ANY THIRD PARTY ARISING FROM OR RELATED TO THE USE OF, INABILITY TO USE, OR THE TERMINATION OF THE USE OF THE SERVICES, REGARDLESS OF THE FORM OF ACTION OR CLAIM (WHETHER CONTRACT, TORT, STRICT LIABILITY OR OTHERWISE), EVEN IF THE CREDIT UNION HAS BEEN INFORMED OF THE POSSIBILITY THEREOF.

Effective 8/01/18

Mobile Deposit How To

Endorse Your Check!

Don't forget to endorse the back of your check by signing your name and writing "For GFCU Mobile Deposit Only" below your signature.