Mobile Deposit How-to

Mobile Check Deposit How To

To use Deposit Check in the Mobile App, you will need a Greenville Federal Credit Union checking account and have the Mobile Banking App installed on your smart phone or tablet. There is no cost to use Deposit Check!

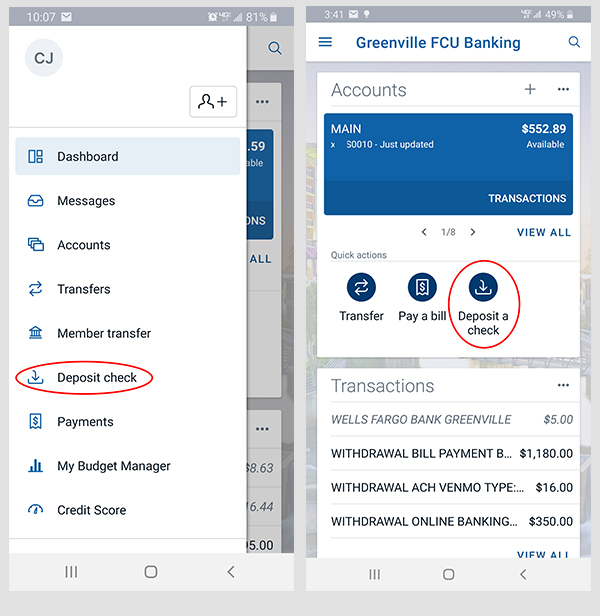

Ready to get started? You can deposit a check* right from your mobile device by following these steps.

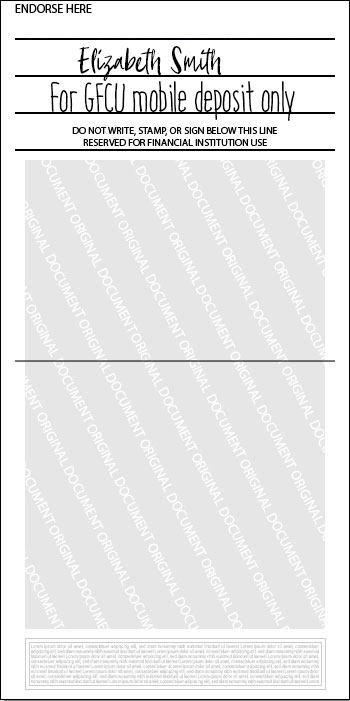

Prepare Your Check for Mobile Deposit

- Sign/Endorse the back of your check and write "For GFCU Mobile Deposit Only".

- Log into the Greenville FCU Banking mobile app and select "Deposit check" from the menu.

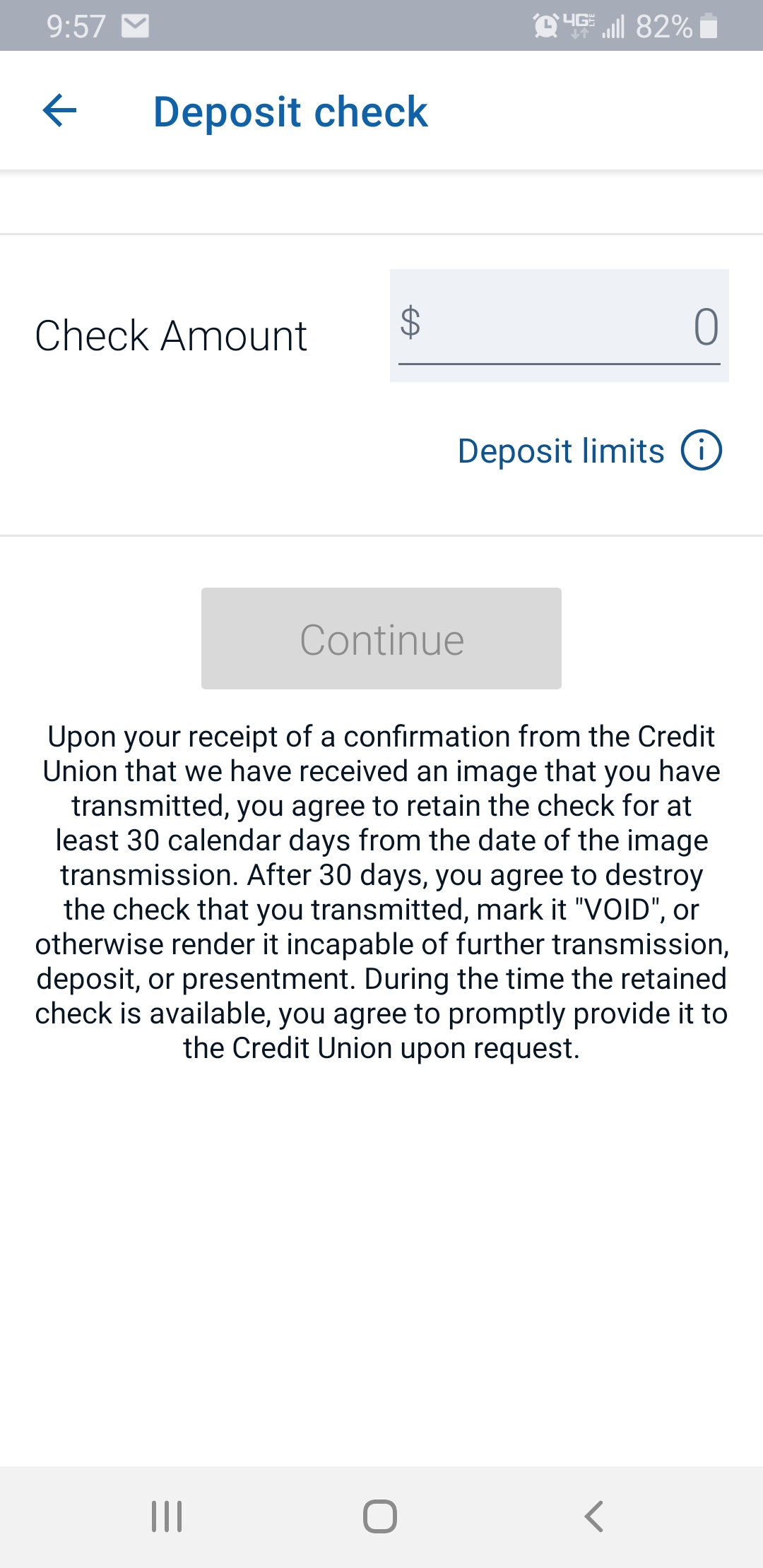

- When prompted for the amount, carefully enter the check amount to ensure it matches the amount written on your check, and select "Continue".

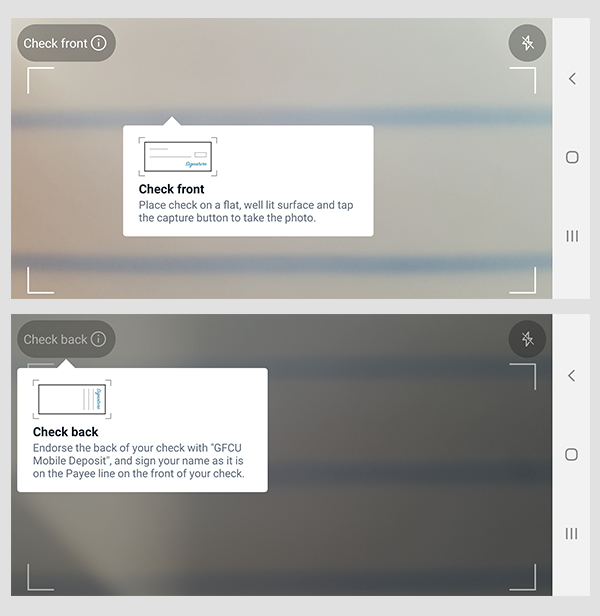

Take a Photo of Your Check

- Flatten folded or crumpled checks before taking photos.

- Keep the check within the view finder on the camera screen when capturing your photos. Try not to get too much of the areas surrounding the check.

- Do not zoom into the check. Instead, move your phone closer to the check.

- Take photos of your check in a well-lit area. Place the check on solid dark background before taking the photo of it.

- Keep your phone or iPad flat and steady above the check when taking your photos.

- Hold the camera as square to the check as possible to reduce corner to corner skew.

- Make sure the entire check image is visible and in focus before submitting your deposit.

- Ensure there are no shadows across the check, all four corners are visible, the check is not blurry and the MICR line (numbers on the bottom of your check) is readable.

Confirm Your Deposit

Mobile check deposits received prior to 2:00 pm EST on business days are processed by close of business the same day. Mobile check deposits received after 2:00 pm EST or on weekends and holidays when Greenville Federal Credit Union is closed, will be processed by close of business the next business day.

Your mobile check deposit will not complete if it meets any of the following criteria:

- Amount exceeds Daily Deposit Limit $5,000.

- Missing "For GFCU Mobile Deposit Only" on the back of your check.

- Missing signature endorsement on the back of your check.

- Items that are not eligible for Mobile Deposit:

- Checks drawn on banks located outside U.S.

- Checks made payable to others or made payable to a business.

- Remotely created checks - In the place of the account holder’s signature, a printed or typed name is shown instead of the signature of a person on whose account the check is drawn. These are commonly created by credit card companies, utility companies or telemarketers.

- Traveler's Cheques

- Money Orders

- Returned Checks

- Checks suspected to be fraudulent or otherwise not authorized by account owner.

- Checks dated more than 6 months prior to date of deposit.

- Postdated checks

If you have questions regarding mobile check deposit, visit a branch or call 800.336.6309.

* Only members in good standing that meet certain eligibility requirements qualify for this service. This service excludes all Alternative Checking Accounts. View Mobile Deposit Terms and Conditions for more information.

Mobile Deposit Terms and Conditions Agreement

Endorse Your Check!

Don't forget to endorse the back of your check by signing your name and writing "For GFCU Mobile Deposit Only" below your signature.