Notice of Fee Schedule Changes

Notice of Fee Increase for Returned Visa Credit Card Payments, Effective November 1, 2021

The Visa credit card Returned Payment Fee will increase to $37.50 effective November 1, 2021. A Returned Payment Fee is charged when a payment is returned, or not honored. A returned payment can be due to insufficient funds, account closures, or account freezes.

Notice of Courtesy Pay Service and Non-Sufficient Funds (NSF) Changes Effective August 1, 2021

- Recurring debit card payments will be included in Courtesy Pay, in addition to overdrawn checks and Automated Clearing House (ACH) transactions (electronic payments including Bill Pay.)

Any presentment of a recurring debit card payment (as defined by coding provided by merchants you have authorized to use your debit card) will now be included in the Courtesy Pay service. Should the credit union, using its discretion, choose to pay the recurring debit payment into overdraft or while in overdraft, it will be charged the corresponding Courtesy Pay overdraft privilege fee. We will use your Available Balance to determine when your account is overdrawn prior to assessing the Courtesy Pay overdraft privilege fee for items presented. Please refer to the Membership Agreement for definitions of overdraft conditions and the Fee schedule for fees related to presentments which bring the account negative.

The inclusion of recurring debit card payments in the Courtesy Pay service helps members avoid additional merchant NSF (non-sufficient funds) fees, late payment fees and service disruption if payments are declined and returned to the merchant. - Recurring debit card payment presentments will be assessed Non-Sufficient Funds (NSF) fees.

Any presentment of a recurring debit card payment (as defined by coding provided by merchants you have authorized to use your debit card), which places the account into overdraft or is presented while in overdraft, will be charged an NSF fee for each presentment. Your Available Balance will be used to determine when your account is overdrawn. Please refer to the Membership Agreement for definitions of overdraft conditions and the Fee schedule for fees related to presentments which bring the account negative. - Members can opt-in to include ATM and daily, one-time debit card transactions in their Courtesy Pay coverage.

As debit cards have become the overwhelmingly preferred payment method for consumers, the credit union will expand its Courtesy Pay coverage to include ATM and daily, one-time debit card transactions, if requested by the account holder. You must opt-in to receive the expanded Courtesy Pay coverage for daily, one-time debit and ATM overdraft transactions. If you choose not to opt-in, these transactions will continue to be declined when an account is overdrawn or if the transaction places the account into overdraft.

Action Needed! You can opt-in to add ATM withdrawals and daily, one-time debit card transactions to your Courtesy Pay coverage by calling the Contact Center 800-336-6309, sending a secure message through Online/Mobile banking, or by visiting any branch. - The Courtesy Pay coverage limit will increase from $500.00 to $750.00. The $750.00 coverage limit does not include Courtesy Pay fees or NSF fees.

- The credit union will implement a transaction threshold of $5.00 to Courtesy Pay fee assessments.

An account will not be charged a Courtesy Pay fee if the transaction amount is $5.00 or less. This $5 threshold does not apply to in-branch cash withdrawals or cash advances. The $5 threshold cannot be used in multiple consecutive cash withdrawals and ATM transactions. Misuse of the $5 threshold will result in removal of the Courtesy Pay service. - Courtesy Pay and NSF fees will have combined single-day assessment limits.

With the inclusion of ATM and debit transactions in the Courtesy Pay program in addition to overdrawn checks and ACH transactions (electronic payments including Bill Pay), the credit union believes it is important to limit the potential overdraft fee burden to members by capping the total amount of fees that can be assessed in a single day.

In a single day, accounts will be assessed fee of $37.50 for the first two NSF or overdraft presentments the credit union pays in one day. No more than two (2) Courtesy Pay or Non-Sufficient Funds (NSF) fees will be charged per member number, per business day. Transactions with values equal to or less than $5 will not be charged a Courtesy Pay fee.

Example fee assessment in a single day:

Fees for first two presentments above the transaction threshold: $37.50 ea.

Fees for additional presentments: No fee

Maximum number of fees assessed in a single day: 2

Maximum fee amount assessed in a single day: $75.00

You can choose not to have any overdrafts paid through Courtesy Pay, and may make this selection by notifying the credit union in one of these ways:

- In writing to Greenville Federal Credit Union, 1501 Wade Hampton Boulevard, Greenville, SC 29609

- Sending a secure message through your Online or Mobile Banking login

- By visiting a credit union branch office to speak with a representative

NSF transactions may be returned unpaid and subject to returned item fees on accounts that do not have Courtesy Pay overdraft protection coverage. The entity expecting payment from you may also assess a fee for the NSF returned item.

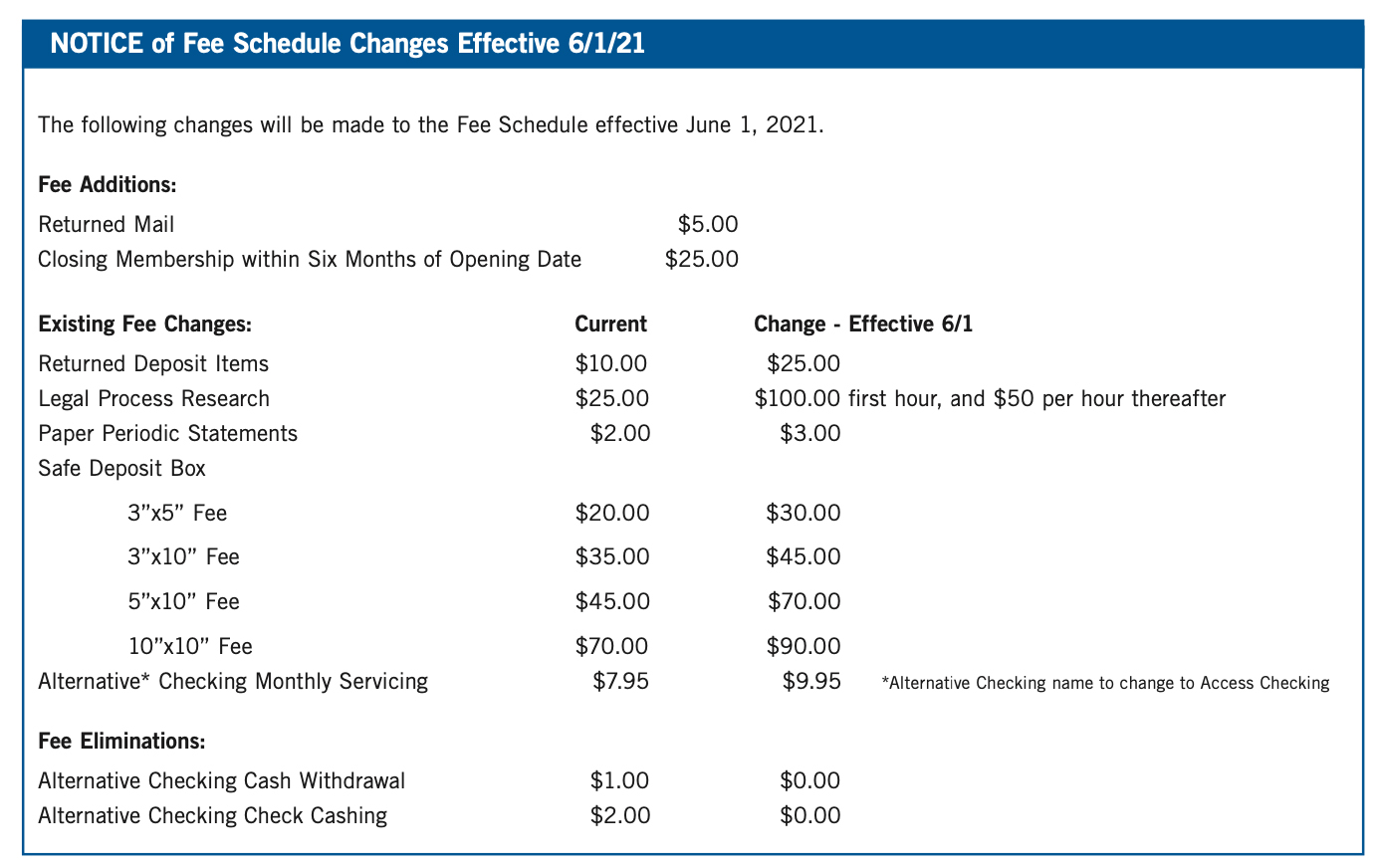

The following changes will be made to the Fee Schedule effective June 1, 2021.