Kiss Credit Card Debt Good-Bye

Credit cards are one of the most convenient forms of payment, and when used responsibly, they help you manage your cash flow and budget effectively. However, this convenience can lead to overspending and land you in a financial pickle. And with prices continuing to rise, more and more people rely on credit cards just to make ends meet.

When you find yourself staring at a steep credit card bill, it can feel like a giant weight on your shoulders. Reducing your balance can seem impossible at times. Don’t fret! We’re here to pull back the curtain on an easy way to regain control over credit card debt - a simple process called debt consolidation.

What is Debt Consolidation?

While “debt consolidation” may sound intimidating, it’s actually very simple and straightforward. Consolidating debt involves combining multiple credit card and personal loan balances into a single loan. The goal is to obtain more favorable loan terms and secure a lower interest rate to help you pay less interest and make managing your debts much easier.

Who Will Benefit from Consolidating Debt?

Many assume debt consolidation will only benefit those with significant outstanding credit card balances. However, that’s a myth. The truth is that debt consolidation can help anyone – even if you only have a couple credit cards.

Here are some of the most common uses of debt consolidation:

- You have multiple credit cards

- Your credit card(s) have high interest rates

- You have higher-rate personal loans

- You’re overwhelmed with Buy Now, Pay Later bills or payday loans

- You’re struggling to make your current credit card payments

- Your credit score is suffering from too much unsecured debt

What are the Benefits of Debt

Consolidation? When you consolidate your

outstanding balances, you’ll instantly feel a weight lifted off your shoulders.

Aside from taking the first step toward a brighter financial future, you’ll

experience various perks:

- Immediate Savings: Consolidating higher-rate debt into a lower-rate loan will provide immediate financial relief. With lower interest charges, you’ll have more opportunities to pay down your balance and ultimately put a substantial amount of money back into your budget.

- Easier Debt Management: Rather than juggling multiple payments with varying due dates throughout the month, consolidating debt leaves you with only one balance and monthly payment. Not only will you save money, but you’ll also eliminate stress.

- Lower Rates = Less Interest: Most people don’t realize how much they spend monthly on interest charges until they consolidate into a lower rate. High-interest credit cards and short-term loans will eat away at your budget and make you feel like you’re never making progress in reducing your debt. With a lower interest rate, you’ll immediately save money in the short and long term.

- Quicker Payoffs: When you consolidate debt into a lower interest rate with more favorable terms, you’re more likely to eliminate your debt quicker. Having your debt-free date within your sights rather than a far-off concept gives you something to look forward to and helps you maintain your motivation as you work toward your goal.

How Does Debt Consolidation Work?

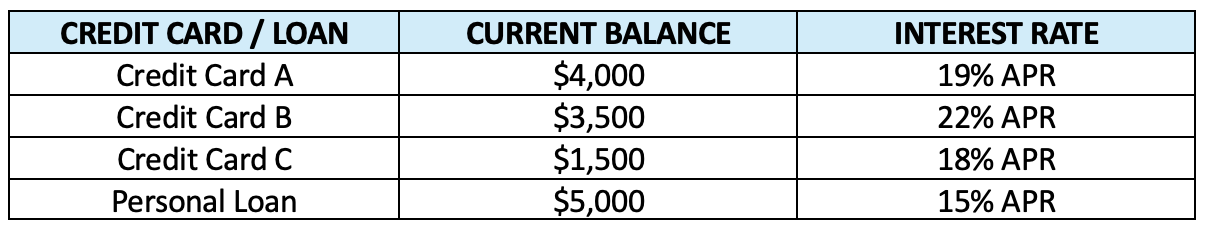

The best way to explain debt consolidation is through an example. Let’s say you have a mix of credit cards and personal loans, each with different balances and interest rates:

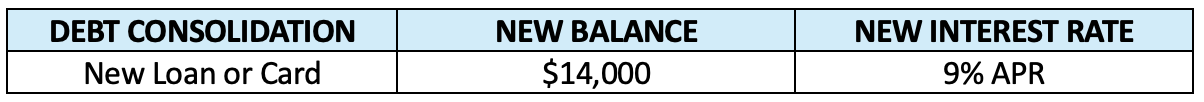

Your total outstanding balances equal $14,000, all with high interest rates. When you consolidate debt, these balances will be moved to a lower-rate loan or credit card.

When you combine your outstanding debts into a single loan or credit card at a lower interest rate, you’ll immediately and substantially reduce how much interest you pay monthly. Plus, with a lower interest rate, more of your monthly payment will go toward the principal balance (the amount you owe) and not toward costly interest charges – allowing you to become debt-free faster.

Is It Better to Consolidate with a Credit Card or Personal Loan?

There are multiple ways to consolidate debt, each with its own benefits and drawbacks. Two of the most common methods are credit card balance transfers and personal loans. However, a third option, a home equity loan, is also a viable choice.

- Credit

Card Balance Transfers: A balance transfer allows you to move existing debt

from your credit card(s) to a new one, ideally securing a much lower interest

rate. Balance transfers let you consolidate credit card debt from multiple

cards into a single, more manageable monthly payment. You may also be able to

take advantage of credit card promotional offers to secure an even lower rate. The biggest drawbacks of balance transfers are the

potential fees and the ability to pay additional interest charges. Many credit

cards have balance transfer fees – so ensure your new card does not charge

these fees before you transfer. Secondly, credit cards only require a minimum

monthly payment – which can cause you to pay more interest over the long run.

- Debt

Consolidation Loans: A debt

consolidation (personal) loan groups all your existing high-interest credit

cards and personal loans into a single, new loan. These loans act much like a

car loan, where you have set monthly payments. The benefit is that you’ll pay less

interest and eliminate the balance much faster than making minimum payments on

a credit card.

- Home Equity Loan: Utilizing a Home Equity Loan or a Home Equity Line of Credit (HELOC) is a great way to leverage your home’s value to improve your finances. Home Equity Loans allow you to borrow against the value you’ve built up in your home and use those funds to consolidate and pay off debt. Since the loan is secured using your home as collateral, interest rates on secured loans are significantly lower than unsecured loans. Plus, the longer loan terms help make payments more manageable. This might be your best option if your outstanding balances are substantial.

Ready to Get Started?

Consolidating debt can sound intensive and not worth the time and energy. However, the process is simple, and the financial benefits are immediate. Here is all that you need to do:

- Obtain statements of all your outstanding credit cards, personal loans, medical bills, payday loans, etc.

- Bring your statements to any branch for a consultation with one of our member service representatives.

- Our team will analyze your outstanding debts and make suggestions on how to best tackle your debt while providing the most significant savings.

- You choose the option that works best for you.

We’re Here to Help!

Credit card debt has a way of sneaking up on you. At first, it seems manageable, but life happens. Unexpected expenses pop up, everyday prices rise, and more can derail your repayment plan. Before debt takes over your financial life, be proactive and regain control through debt consolidation.

If you’re ready to eliminate high-interest debts and watch your credit card balances continue to decline, we’re ready to help. Please stop by any of our convenient branch locations or call 800-336-6309 to schedule an appointment today.

Each individual’s financial situation is unique and readers are encouraged to contact the credit union when seeking financial advice on the products and services discussed. This article is for educational purposes only.